Here are the cars eligible for the $7,500 EV tax credit in the United States:

Image: EV Federal Tax Credits

The image above provides information on the federal tax credits available for electric vehicles (EVs) in the United States. These tax credits can help offset the cost of purchasing an electric car and make them more affordable for consumers.

Image: EV Tax Credit 2022 Cap

The image above illustrates the current cap for the EV tax credit in 2022. It shows the maximum amount of credit a consumer can receive when purchasing an eligible electric vehicle.

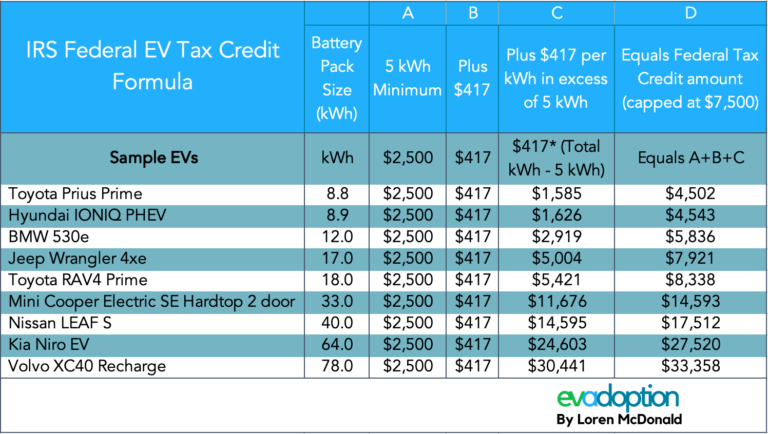

Image: Federal EV Tax Credit Calculation

This image provides an example of how the federal tax credit amount is calculated for each electric vehicle. The calculation takes into account factors such as the battery size and efficiency of the vehicle to determine the credit amount.

Image: How US Federal Tax Credit for Electric Vehicles Work

This image explains how the US federal tax credit for electric vehicles works. It provides an overview of the eligibility criteria, application process, and the benefits of availing this tax credit.

Image: Flaws in Toyota EV Tax Credit 2023

This image highlights the flaws in the current federal EV tax credit formula, specifically in relation to Toyota electric vehicles. It discusses ongoing efforts to redesign and fix the tax credit system to provide more accurate credits for consumers.

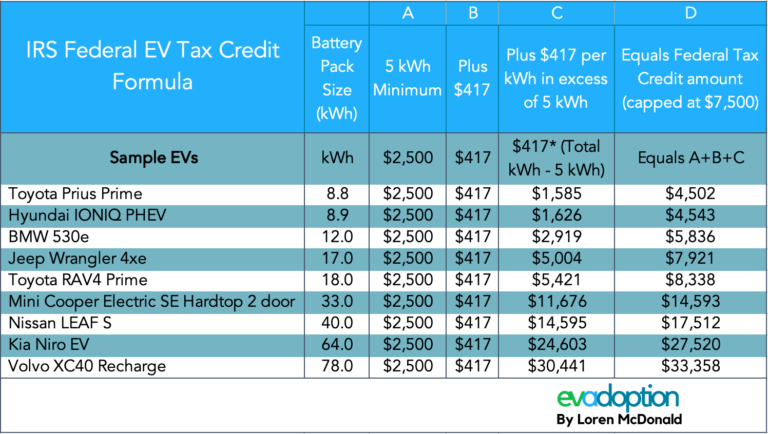

Image: Proposed Changes to the Federal EV Tax Credit

This image showcases the proposed changes to the federal EV tax credit system. It presents a table illustrating the potential impact of these changes on different electric vehicle models and their respective credit amounts.

Image: Electric Car Tax Credit 2022

Lastly, this image provides information on the available tax credits for electric cars in 2022. It highlights the various credit amounts and eligibility criteria for consumers interested in purchasing an electric vehicle.

In conclusion, understanding the federal tax credits available for electric vehicles is crucial for those considering an EV purchase in the United States. These tax credits can significantly reduce the upfront cost of buying an electric car and promote the adoption of sustainable transportation options. It is important to stay up-to-date with the latest changes to the tax credit system and consult with tax professionals or EV experts to maximize the benefits of these credits.

If you are searching about Impact of Proposed Changes to the Federal EV Tax Credit – Part 1 you've came to the right place. We have 8 Pics about Impact of Proposed Changes to the Federal EV Tax Credit – Part 1 like ev tax credit 2022 cap - Stamps Podcast Bildergallerie, Here are the cars eligible for the $7,500 EV tax credit in the and also Toyota Ev Tax Credit 2023 Flaws Redesigning Fixing Evadoption. Here you go:

Impact Of Proposed Changes To The Federal EV Tax Credit – Part 1

evadoption.com

evadoption.com proposed evadoption

Electric Car Tax Credit 2022 Electric Car Tax Credits: What's Available?

chevroletscar.blogspot.com

chevroletscar.blogspot.com Ev Tax Credit 2022 Cap - Stamps Podcast Bildergallerie

cafebarfankey.blogspot.com

cafebarfankey.blogspot.com How The Federal EV Tax Credit Amount Is Calculated For Each EV | EVAdoption

evadoption.com

evadoption.com federal evs calculated evadoption calculation

EVAdoption

evadoption.com

evadoption.com federal evadoption proposed

Toyota Ev Tax Credit 2023 Flaws Redesigning Fixing Evadoption

diningroomscollection.blogspot.com

diningroomscollection.blogspot.com Here Are The Cars Eligible For The $7,500 EV Tax Credit In The

www.autopromag.com

www.autopromag.com How Does US Federal Tax Credit For Electric Vehicles Work? | Update On

www.emobilitysimplified.com

www.emobilitysimplified.com incentives

Impact of proposed changes to the federal ev tax credit – part 1. Proposed evadoption. How the federal ev tax credit amount is calculated for each ev

0 comments