Electric car tax credits have become an increasingly popular topic of discussion in recent years. As the world shifts toward a more sustainable future, governments around the globe have introduced various incentives to encourage the adoption of electric vehicles (EVs). In the United States, one of the key incentives is the federal tax credit for electric vehicles. This tax credit provides financial assistance to individuals who purchase qualifying electric vehicles, helping to make EVs more accessible and affordable for consumers.

Electric Car Tax Credit 2022: What's Available?

One of the primary questions on the minds of potential electric car buyers is what tax credits are available in 2022. The federal government provides a tax credit of up to $7,500 for the purchase of a qualifying electric vehicle. However, it is important to note that the full tax credit is only available for the first 200,000 electric vehicles sold by each automaker. Once an automaker reaches this threshold, the tax credit begins to phase out. This means that the size of the tax credit decreases over time until it eventually expires.

It is also worth mentioning that the exact amount of the tax credit may vary depending on the specific make and model of the electric vehicle. Vehicles with larger battery capacities typically receive a higher tax credit.

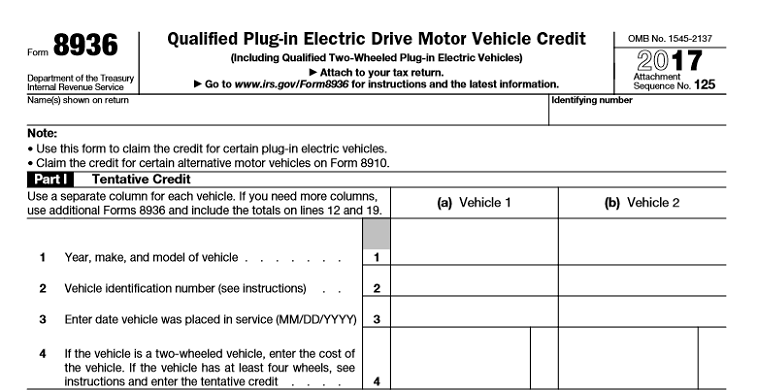

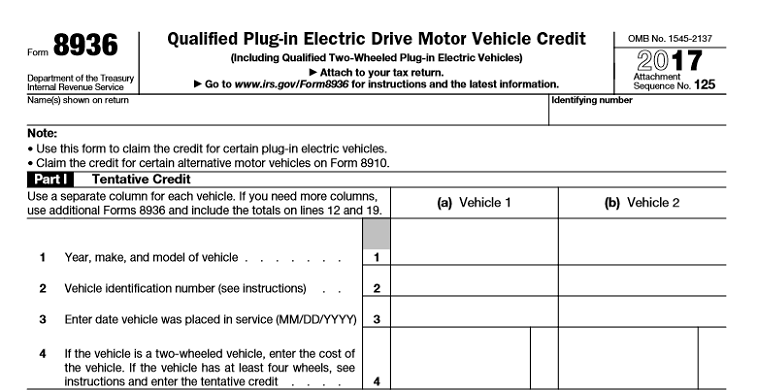

How Does the US Federal Tax Credit for Electric Vehicles Work?

Understanding how the US federal tax credit for electric vehicles works is essential for anyone considering purchasing an EV. The tax credit is applied to your federal income tax return and directly reduces the amount of tax you owe. If your tax liability is lower than the tax credit, you can carry over the remaining credit to future tax years.

It is important to note that the electric vehicle tax credit is non-refundable, which means it can only be used to offset your tax liability. If you do not owe any federal income tax, you will not receive a refund for the unused portion of the tax credit.

Federal EV Tax Credit Phase Out Tracker By Automaker

Tracking the phase out of the federal EV tax credit is crucial for consumers who want to maximize their savings. The tracker above displays the progress of each automaker towards the 200,000 EV sales threshold. Once an automaker reaches this threshold, the tax credit begins to decrease. It is important to check the current status of the tax credit for the specific make and model you are interested in to determine the applicable tax credit amount.

EV Tax Credit 2022 Cap

As mentioned earlier, the federal tax credit for electric vehicles has a cap of $7,500. This means that regardless of the purchase price of the EV, the maximum tax credit amount you can claim is $7,500. However, it is important to note that the tax credit cannot exceed the total amount of federal income tax you owe for the tax year.

How to Calculate Electric Car Tax Credit

Calculating the electric car tax credit can be a bit complex, as several factors come into play. The tax credit is based on the battery capacity of the electric vehicle, with larger battery capacities generally resulting in a higher credit amount. To calculate the exact tax credit for a specific electric vehicle, you can refer to the manufacturer's information or consult with a tax professional.

Electric Vehicles Eligible for the $7,500 EV Tax Credit in the USA

Not all electric vehicles are eligible for the maximum $7,500 tax credit. The tax credit amount depends on the make and model of the electric vehicle, as well as the manufacturer's current sales volume. It is crucial to check the eligibility criteria and the available tax credit for the electric vehicle you are interested in before making a purchase decision.

How Does EV Tax Credit Work in India?

While this discussion has mainly focused on the US federal EV tax credit, it is important to mention that other countries, such as India, also offer incentives for electric vehicles. The specifics of the tax credits and incentives may vary depending on the country's policies and regulations. If you are considering purchasing an electric vehicle in India, it is recommended to explore the available incentives and tax credits specific to your region.

Concluding thoughts: Electric car tax credits play a vital role in promoting the adoption of electric vehicles by making them more cost-effective for consumers. The federal tax credit in the United States provides a significant financial incentive for individuals to go electric. However, it is important to stay informed about the current status of the tax credit, as well as the eligibility criteria and phase-out thresholds set by each automaker. Consult with your tax advisor or explore reliable sources to ensure you maximize the available tax credits and incentives when purchasing an electric vehicle.

If you are looking for How does US Federal Tax Credit for Electric Vehicles work? | Update on you've came to the right web. We have 8 Pics about How does US Federal Tax Credit for Electric Vehicles work? | Update on like Here are the cars eligible for the $7,500 EV tax credit in the, How To Calculate Electric Car Tax Credit – OsVehicle and also How Does Ev Tax Credit Work - TaxesTalk.net. Here it is:

How Does US Federal Tax Credit For Electric Vehicles Work? | Update On

www.emobilitysimplified.com

www.emobilitysimplified.com incentives

Electric Car Tax Credit 2022 Electric Car Tax Credits: What's Available?

chevroletscar.blogspot.com

chevroletscar.blogspot.com How Does Ev Tax Credit Work - TaxesTalk.net

www.taxestalk.net

www.taxestalk.net Ev Tax Credit 2022 Cap - Stamps Podcast Bildergallerie

cafebarfankey.blogspot.com

cafebarfankey.blogspot.com How To Calculate Electric Car Tax Credit – OsVehicle

www.osvehicle.com

www.osvehicle.com Federal EV Tax Credit Phase Out Tracker By Automaker – EVAdoption

evadoption.com

evadoption.com automaker evadoption atl

How To Get EV Tax Credit - Evs101.com

evs101.com

evs101.com tax irs levy sba disaster assessment qualify resources ev credit loan finance off buyer guides tips reviews ca quickbooks write

Here Are The Cars Eligible For The $7,500 EV Tax Credit In The

www.autopromag.com

www.autopromag.com Here are the cars eligible for the $7,500 ev tax credit in the. Tax irs levy sba disaster assessment qualify resources ev credit loan finance off buyer guides tips reviews ca quickbooks write. How does ev tax credit work

0 comments