The 2018 Electric Vehicle Tax Credit – OsVehicle

The 2018 Electric Vehicle Tax Credit Explained

If you are considering purchasing an electric vehicle (EV) or already own one, you may be eligible for a tax credit. The 2018 Electric Vehicle Tax Credit is a government incentive designed to promote the adoption of electric vehicles and reduce carbon emissions. In this article, we will break down everything you need to know about this tax credit and how you can benefit from it.

What is the Electric Vehicle Tax Credit?

The Electric Vehicle Tax Credit, also known as the EV Tax Credit or the Plug-In Electric Drive Motor Vehicle Credit, is a federal tax credit offered to individuals who purchase a qualifying plug-in electric vehicle. The amount of the tax credit varies based on the battery capacity of the vehicle and the manufacturer's sales volume.

How Much is the Tax Credit?

The tax credit amount starts at $2,500 and can go up to $7,500, depending on the battery capacity of the vehicle. The more electric range the vehicle has, the higher the tax credit. However, it is important to note that once a manufacturer reaches 200,000 qualifying vehicles sold, the tax credit begins to phase out.

Until recently, several automakers' tax credits had already phased out completely, including Tesla and General Motors. However, as of the latest update, these automakers' tax credits may be reinstated, pending legislative changes. Therefore, it is crucial to stay updated on the latest news regarding the status of the tax credits for different manufacturers.

If you are considering purchasing an electric vehicle, it is advisable to check with the manufacturer to determine the eligibility and amount of the tax credit for their specific vehicles.

How to Claim the Tax Credit

In order to claim the Electric Vehicle Tax Credit, individuals must meet certain eligibility criteria and follow the necessary steps. Here's a step-by-step guide on how to claim the tax credit:

Step 1: Determine Eligibility

Firstly, you need to ensure that you are eligible for the tax credit. To be eligible, the vehicle must meet the following criteria:

- The vehicle must be a new, qualified plug-in electric vehicle

- The vehicle must be acquired for personal use or use in your business

- The vehicle must have at least four wheels

- The maximum credit amount varies depending on the battery capacity, ranging from $2,500 to $7,500

Electric Car Tax Credit Eligibility Criteria

Step 2: Gather Necessary Documents

Before claiming the tax credit, you need to gather all the necessary documents. These documents may include:

- Proof of purchase or lease agreement for the qualifying electric vehicle

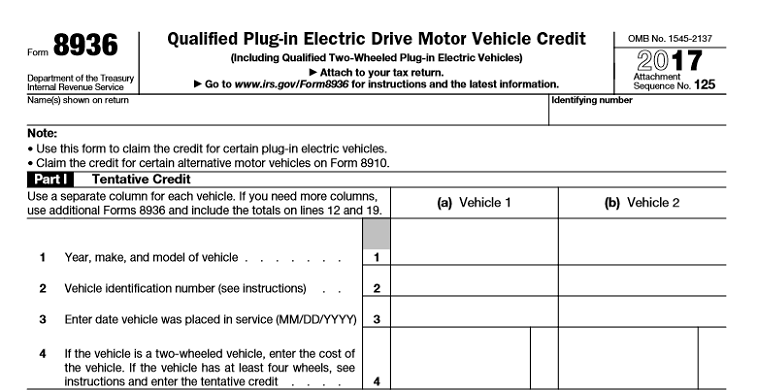

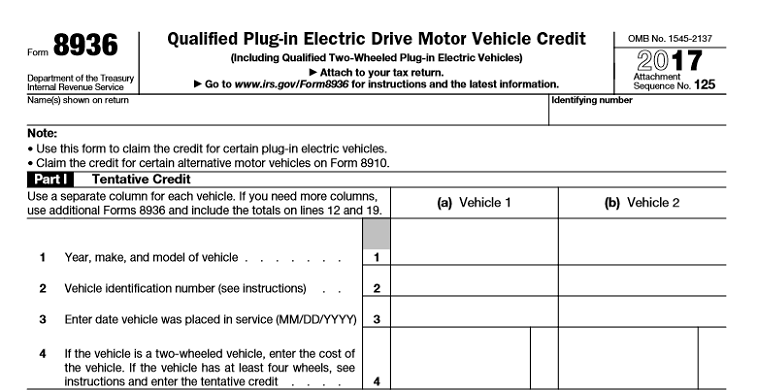

- IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit

- Any other supporting documents required by the Internal Revenue Service (IRS)

It is important to keep these documents in a safe place, as they may be required for future reference or audits.

Step 3: Complete IRS Form 8936

Once you have gathered all the necessary documents, you need to complete IRS Form 8936. This form is specifically designed for claiming the Electric Vehicle Tax Credit. It requires you to provide details about the qualifying vehicle, including the make, model, and vehicle identification number (VIN).

Additionally, you will need to calculate the tax credit amount based on the battery capacity of the vehicle. The IRS provides detailed instructions on how to fill out the form and calculate the tax credit.

What's Available for Electric Car Tax Credits in 2022?

Step 4: File Your Tax Return

Once you have completed IRS Form 8936, you need to include it with your federal income tax return. The tax credit will be applied to your tax liability, reducing the amount of taxes you owe. If the tax credit exceeds your tax liability, the remaining amount may not be refunded.

It is essential to file your tax return accurately and on time to ensure that you receive the tax credit. Late filings or errors on the form may result in delays or denial of the tax credit.

Electric Vehicle Tax Credit: What to Know for 2020

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Step 5: Receive Your Tax Credit

Once your tax return is processed by the IRS, and if you are eligible for the tax credit, it will be applied to your tax liability. If you owe taxes, the tax credit will reduce the amount you owe. If you do not owe taxes, you may receive the tax credit as a refund.

It is important to note that the tax credit is non-refundable, meaning it cannot exceed your tax liability. Therefore, it is crucial to accurately calculate the tax credit amount and ensure that you have enough tax liability to claim the full credit.

EV Tax Credit May Not Be Scrapped After All

Additional Considerations

Here are a few additional considerations to keep in mind regarding the Electric Vehicle Tax Credit:

- The tax credit is subject to change. The amount and availability of the tax credit may be altered by legislative changes. It is essential to stay updated on the latest news and changes regarding the tax credit.

- The tax credit is non-transferable. Only the original buyer or lessee of the qualifying electric vehicle can claim the tax credit. If you purchase a used electric vehicle, you may not be eligible for the tax credit.

- The tax credit is limited to federal taxes. The tax credit can only be applied to your federal income tax liability. It does not apply to state or local taxes.

- The tax credit may not be available for all electric vehicles. Some electric vehicles may not qualify for the tax credit, either due to their battery capacity or the manufacturer's sales volume.

Electrical Car Tax Credit and Rebates Accessible Within The US

Conclusion

The 2018 Electric Vehicle Tax Credit is a valuable incentive for individuals considering the purchase of an electric vehicle. By claiming this tax credit, you can not only contribute to a greener and more sustainable future but also save money on your tax liability.

It is important to understand the eligibility criteria, the necessary steps for claiming the tax credit, and any legislative changes that may affect the availability and amount of the tax credit. By staying informed and following the guidelines, you can take advantage of the benefits offered by the Electric Vehicle Tax Credit.

Remember, the information provided in this article is for general informational purposes only and should not be considered as tax or legal advice. It is advisable to consult with a professional tax advisor or the Internal Revenue Service (IRS) for specific guidance regarding your individual situation.

If you are searching about electric car tax credit 2022 Electric car tax credits: what's available? you've came to the right web. We have 8 Images about electric car tax credit 2022 Electric car tax credits: what's available? like Electrical Car Tax Credit And Rebates Accessible Within The US, Sorted, ev tax credit 2022 cap - Clement Wesley and also electric car tax credit 2022 Electric car tax credits: what's available?. Here you go:

Electric Car Tax Credit 2022 Electric Car Tax Credits: What's Available?

chevroletscar.blogspot.com

chevroletscar.blogspot.com Electrical Car Tax Credit And Rebates Accessible Within The US, Sorted

theglobaltoday.com

theglobaltoday.com How Does US Federal Tax Credit For Electric Vehicles Work? | Update On

www.emobilitysimplified.com

www.emobilitysimplified.com incentives

The 2018 Electric Vehicle Tax Credit – OsVehicle

www.osvehicle.com

www.osvehicle.com Federal EV Tax Credit Phase Out Tracker By Automaker – EVAdoption

evadoption.com

evadoption.com automaker evadoption atl

Ev Tax Credit 2022 Cap - Clement Wesley

clementwesley.blogspot.com

clementwesley.blogspot.com EV Tax Credit May Not Be Scrapped After All | Carscoops

www.carscoops.com

www.carscoops.com scrapped carscoops

Electric Vehicle Tax Credit: What To Know For 2020 – Action News Jax

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) www.actionnewsjax.com

www.actionnewsjax.com calculate

How does us federal tax credit for electric vehicles work?. The 2018 electric vehicle tax credit – osvehicle. Federal ev tax credit phase out tracker by automaker – evadoption

0 comments