Are you thinking about purchasing an electric vehicle? Well, there's some good news for you! The IRS EV Tax Credit for 2023 can help you save some money. Let's take a closer look at who can qualify for this credit and the qualified vehicles that are eligible.

Qualified Vehicles for IRS EV Tax Credit 2023

If you are considering purchasing an electric vehicle, it is important to know if the vehicle is eligible for the IRS EV Tax Credit. You can find a list of qualified vehicles on the IRS website or contact your local dealership for more information.

The IRS EV Tax Credit covers a wide range of electric vehicles. From sedans to SUVs, there are plenty of options to choose from. When shopping for an electric vehicle, make sure to check if it qualifies for the tax credit.

With the IRS EV Charger Tax Credit, you can also receive credits for installing the necessary charging infrastructure at your home. This credit helps make owning an electric vehicle even more convenient and cost-effective.

By taking advantage of the tax credits available, you can get up to $7,500 in credits towards the purchase of your electric vehicle. This substantial savings can help offset the initial cost of buying an electric vehicle.

It's important to note that not all electric vehicles are eligible for the IRS EV Tax Credit. To determine if a specific vehicle qualifies, you should consult the IRS guidelines or speak with a tax professional.

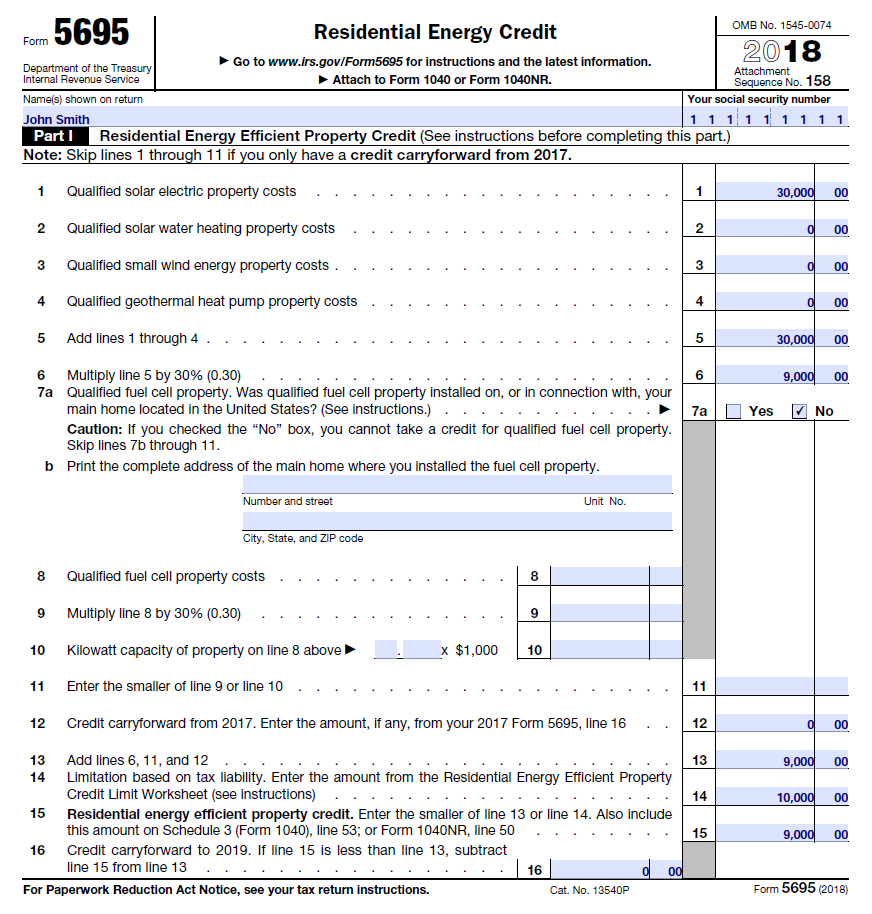

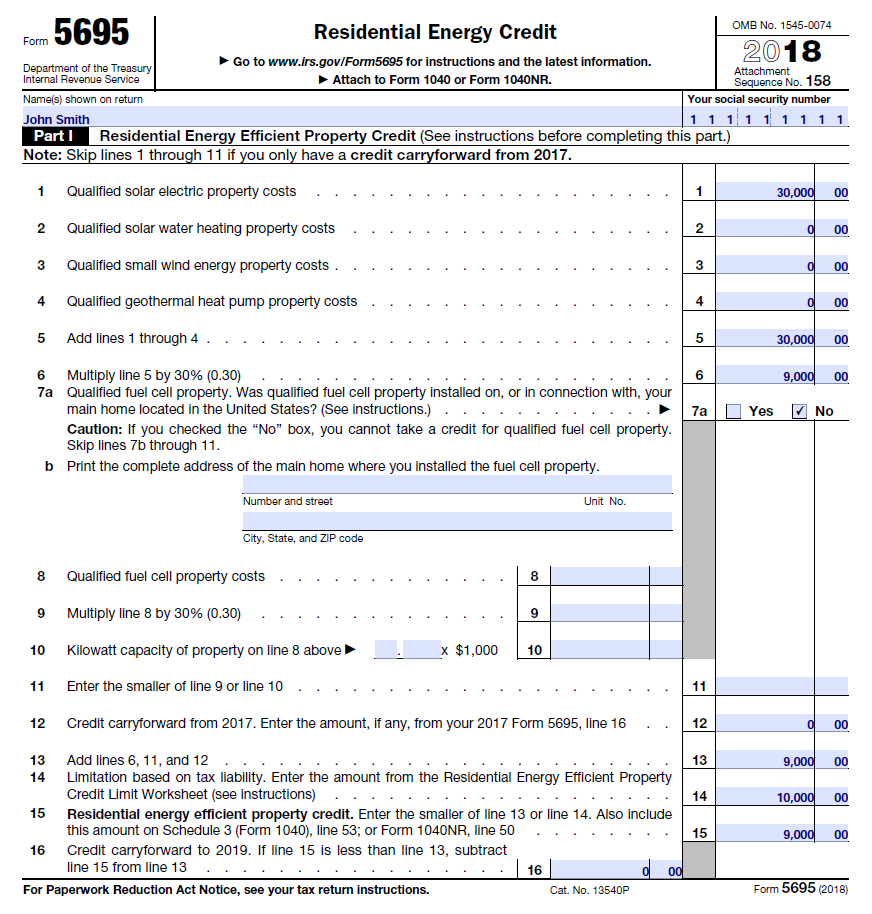

In addition to the IRS EV Tax Credit, there is also a Home Energy Tax Credit available for homeowners who invest in energy-efficient upgrades. This credit can help offset the cost of installing solar panels or other renewable energy systems.

Finally, you might be wondering if the IRS has extended the credit for electric cars. As of now, the tax credit is available, but it's always a good idea to stay informed about any updates or changes to tax laws.

Overall, the IRS EV Tax Credit for 2023 provides a great opportunity for savings when purchasing an electric vehicle. By understanding the qualifications and eligible vehicles, you can make an informed decision that benefits both your wallet and the environment.

The information provided here is for general informational purposes only and should not be considered tax advice. Please consult with a tax professional for personalized advice specific to your situation.

If you are looking for IRS EV Tax Credit 2023, Who Can Qualify? Qualified Vehicles - बड़ी सोच you've came to the right web. We have 8 Pictures about IRS EV Tax Credit 2023, Who Can Qualify? Qualified Vehicles - बड़ी सोच like How To Calculate Electric Car Tax Credit – OsVehicle, Has Irs Extended The Credit For Electric Cars – OsVehicle and also Irs Ev Charger Tax Credit 2021 - veche. Here it is:

IRS EV Tax Credit 2023, Who Can Qualify? Qualified Vehicles - बड़ी सोच

badisoch.in

badisoch.in Has Irs Extended The Credit For Electric Cars – OsVehicle

www.osvehicle.com

www.osvehicle.com How To Calculate Electric Car Tax Credit – OsVehicle

www.osvehicle.com

www.osvehicle.com IRS EV Tax Credit 2023, Who Can Qualify? Qualified Vehicles

jkdsd.org

jkdsd.org IRS EV Tax Credit 2023, Who Can Qualify? Qualified Vehicles

teqip.in

teqip.in Get Up To $7,500 In Tax Credits For Your Electric Vehicle - Buy An EV

www.threerowselectric.com

www.threerowselectric.com Irs Ev Charger Tax Credit 2021 - Veche

www.veche.info

www.veche.info Home Energy Tax Credit Documentation

sozai-design.blogspot.com

sozai-design.blogspot.com 5695 residential federal sozai

How to calculate electric car tax credit – osvehicle. Irs ev tax credit 2023, who can qualify? qualified vehicles. Irs ev charger tax credit 2021

0 comments